Consumer Studies Major

Why Study Consumer Studies at Virginia Tech?

You might like this major if you're interested in fields like advertising, market research, public relations, management, or government. A consumer studies degree provides a core professional curriculum of business and consumer courses and opportunities for hands-on learning. This major is close-knit, which allows you to be close to classmates and professors as you do hands-on projects and activities in class.

17:1

Student-Faculty Ratio

24

Average Class Size

88%

Of Students Complete Internships

Careers and Further Study

What can you do with a major in Consumer Studies?

Jobs Held by Our Graduates

- American Red Cross

- Consumer Federation of America

- Consumer Product Safety Commission

- Consumers Union

- Cooperative Extension

- Society of Consumer Affairs Professionals International

- Virginia Department of Agriculture and Consumer Services

- Enterprise Cars

- Ryan Homes

- Sherwin Williams

Beyond the Classroom

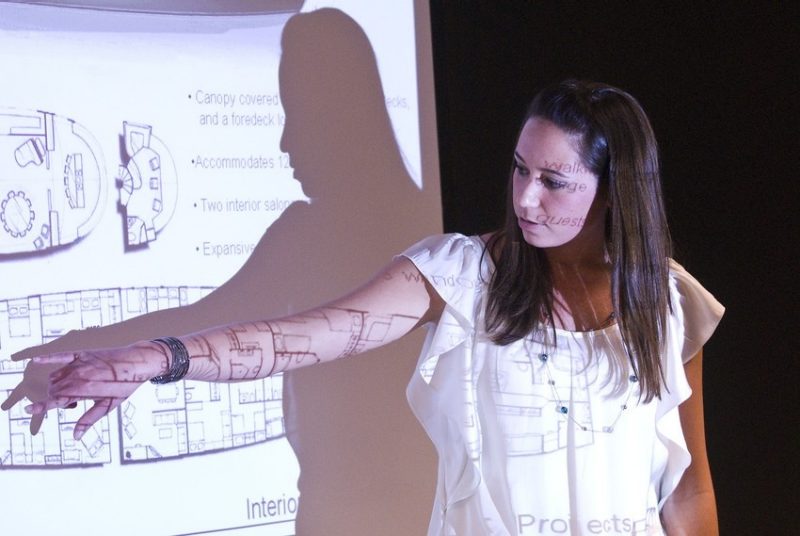

Experiential Learning

- UNDERGRADUATE RESEARCH

- INTERNSHIPS

- LAB SPACE

- FACULTY MENTORS

- ASSOCIATION FOR FINANCIAL COUNSELING & PLANNING EDUCATION REGISTERED EDUCATION PROGRAM

Talk to a professor about designing your own research project or investigating a topic that interests you. You'll work closely with a faculty mentor to plan a course of action, discuss your findings, and write a report. You can also participate in a collaborative project, where you assist a faculty member with their research.

By working in the field, you'll earn job experience and learn more about the industry. Students have recently interned with local businesses, national corporations, and market research firms.

The Consumer Education Lab is a flexible space where you can research, plan, and develop consumer education materials and strategies. It facilitates one-on-one and small group consumer education. Activities include group meetings, participating in webinars, peer budget counseling, and editing videos.

Our faculty has a mix of industry professionals and teaching and research scholars. Whether your interests are in a career as a market researcher, financial planning, or going on to get a Ph.D., there's a mentor for you here.

Consumer Studies at Virginia Tech is one of the AFCPE's Registered Education Programs. By completing a two-course education program, students are qualified to take the Accredited Financial Counselor® (AFC®) certification exam. The AFC® certification marks the highest standard of excellence in the field of financial counseling and education.

Financial counselors specialize in navigating everyday financial challenges and building effective financial habits. They have the education and experience to help an individual or family – from any background or income level – overcome an immediate financial crisis, create an effective spending plan, overcome debt, build savings, and identify ineffective money management behaviors.

Financial counseling believes that the best financial advice considers more than just dollars and cents. The AFC® certification helps financial counselors better understand how diverse backgrounds, perspectives, and experiences impact a client’s money behaviors.

Interested in pursuing the AFC® Certification? Here's how!

1. Complete the following two courses at Virginia Tech:

- CONS 2304 Consumer and Family Finances

- CONS 4324 Financial Counseling

2. Pass the AFC® certifying exam.

3. Work 1,000 hours in financial counseling or financial education.

4. Agree to abide by the AFC® Code of Ethics.

Questions? Contact Kevin Cheng.

Bachelor of Science in Apparel, Housing, and Resource Management Degree

- Including Virginia Tech's Pathways

Consumer Studies Major Requirements

- Economic Well-Being

- Product Analysis

- Business Fundamentals

- Consumer Product and Promotion

- Consumer Financial Services and Counseling

Minor and Elective Hours

Our program gives you the opportunity to build knowledge in another area by pursuing a minor, double major, or cognate.

120 hrs

B.S. Apparel, Housing, and Resource Management

45 hrs

General Education

58 hrs

Major Requirements

17 hrs

Elective

Campus Life

Campus Life

Discover all that Virginia Tech has to offer inside and outside of the classroom. Our campus life aims to build communities, promote holistic education, and cultivate environments that offer opportunities for leadership, innovation, and service.